📊 Intro: Going Beyond Price with Market Sentiment

Learn how to access key cryptocurrency market sentiment metrics like open interest (OI) and the long/short ratio using Python and the Bybit API.

In this post, we’ll walk through a complete guide to pulling both OI and long/short ratio data — ideal for building smarter crypto trading bots 🤖.

So, why do we need this data? Because relying only on basic OHLC price data (like we covered in the previous post) often isn't enough to give you a real edge. To build a profitable trading bot, we need to dig deeper into trader behavior — and these two metrics are excellent tools for spotting crowd sentiment and momentum shifts in the market.

📈 What is Open Interest?

Open interest is just the number of active futures contracts still open — not yet closed or settled. Simple as that.

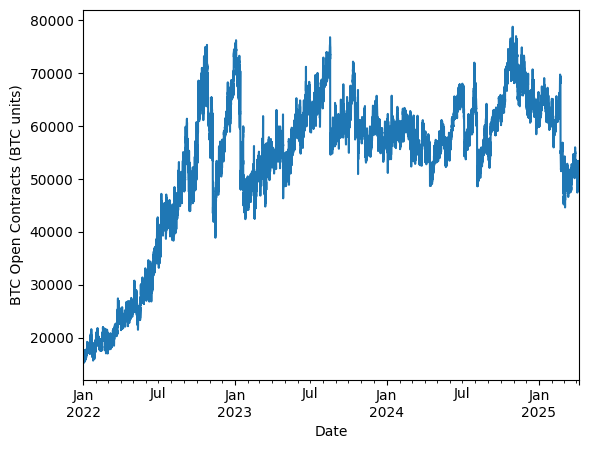

We can use it to gauge market sentiment and momentum 🔍. If OI is rising with price, it usually means strong conviction 💪. If it’s falling, traders might be backing off 😬.

Get OI Data with Python🐍

Here, we’ll use the same get_client method from the previous post, and download, format, and resample the data just like we did with the OHLC section 📊. Easy reuse, same smooth process 💡. We will get BTC open interest, note that this will return a figure that represents that total number of BTC outstanding, i.e. 10,000 OI values means 10k BTC open contracts.

from helpers.get_bybit_http import get_client

import pandas as pd

import matplotlib.pyplot as plt

import datetime as dt

client = get_client(testnet=False)

response = client.get_open_interest(

category="linear",

symbol="BTCUSDT",

intervalTime="1h",

limit=200

).get('result', {}).get('list', [])

response

1️⃣ This returns a list of dictionaries, each containing openInterest and a UTC timestamp ⏱️

[{'openInterest': '51388.99800000', 'timestamp': '1744030800000'},

{'openInterest': '50582.16900000', 'timestamp': '1744027200000'},

{'openInterest': '50717.87800000', 'timestamp': '1744023600000'},

{'openInterest': '51039.16000000', 'timestamp': '1744020000000'},

{'openInterest': '50855.31900000', 'timestamp': '1744016400000'},

{'openInterest': '50662.22800000', 'timestamp': '1744012800000'},

{'openInterest': '50074.49600000', 'timestamp': '1744009200000'},

{'openInterest': '52941.12400000', 'timestamp': '1744005600000'},

{'openInterest': '52412.42300000', 'timestamp': '1744002000000'},

{'openInterest': '52814.07300000', 'timestamp': '1743998400000'},

{'openInterest': '52426.93900000', 'timestamp': '1743994800000'}]

2️⃣ Let’s convert it to a pandas DataFrame to make the data easier to analyse and work with

def format_bybit_oi(response: list[dict]) -> pd.DataFrame:

if not response:

return pd.DataFrame()

df = pd.DataFrame(response)

df['timestamp'] = df.timestamp.astype(int)

df['openInterest'] = df.openInterest.astype(float)

df.index = pd.to_datetime(df.timestamp, unit='ms', utc=True)

return df.sort_index()

oi_data = format_bybit_oi(response=response)

oi_data

'''

openInterest timestamp

timestamp

2025-03-30 06:00:00+00:00 52745.154 1743314400000

2025-03-30 07:00:00+00:00 52641.994 1743318000000

2025-03-30 08:00:00+00:00 52717.180 1743321600000

2025-03-30 09:00:00+00:00 52896.121 1743325200000

2025-03-30 10:00:00+00:00 52970.271 1743328800000

'''

Download & Save All Open Interest Data for Symbol

Getting open interest data from Bybit can be a bit annoying 😅 — the required arguments are slightly different, and the way they handle start and end timestamps isn’t exactly intuitive 🧩.

That said, let’s go ahead and download the BTC open interest data so we can match it up nicely with the OHLC data we pulled in the last post 🔁

import time

def get_last_timestamp(df):

return int(df.timestamp[-1:].values[0])

def increment_oi_timestamp(

start_ts: int, unit: str, n_units: int

) -> int:

increments = {

"1min": 60 * 1000,

"5min": 5 * 60 * 1000,

"15min": 15 * 60 * 100,

"30min": 30 * 60 * 1000,

"1h": 60 * 60 * 1000,

"4h": 4 * 60 * 60 * 100,

"D": 24 * 60 * 60 * 1000,

}

new_ts = increments[unit] * n_units + start_ts

return new_ts

start = int(dt.datetime(2022, 1, 1, tzinfo=dt.timezone.utc).timestamp()* 1000)

interval = "15min"

symbol = 'BTCUSDT'

all_oi = pd.DataFrame()

end = increment_oi_timestamp(start_ts=start, unit=interval, n_units=199)

while True:

response = client.get_open_interest(category='linear',

symbol=symbol,

startTime=start,

endTime=end,

intervalTime=interval, limit=200)

latest = format_bybit_oi(response.get('result', {}).get('list',[]))

start = get_last_timestamp(latest)

end = increment_oi_timestamp(start_ts=start, unit=interval, n_units=199)

time.sleep(0.01)

all_oi = pd.concat([all_oi, latest])

print(f'Collecting data starting {dt.datetime.fromtimestamp(start/1000)}')

if len(latest) == 1: break

all_oi.drop_duplicates(subset=['timestamp'], keep='last', inplace=True)

You should see a printout similar to below ⬇️

Let's plot the data

all_oi['openInterest'].plot()

plt.xlabel('Date')

plt.ylabel('BTC Open Contracts (BTC units)')

## save open interest data to same folder as OHLC

all_oi.to_csv('data/BTC_USDT_OI_15min.csv', index=False)

Change OI Time Interval

Let’s say we want to change the interval — just like we did with the OHLC data in the last post🔁. For example, if we want to resample from 15-minute data to daily, we need to be careful.

Since Open Interest (OI) is a snapshot, not an aggregated metric like OHLC, we should simply take the first observation for each time period 🕒📸 — not the mean, sum, or anything else.

## resample to different timeframe

VALID_RESAMPLE_INTERVALS = ["1min", "5min", "15min", "30min", "h", "D", "W"]

def resample_bybit_oi(df: pd.DataFrame, new_interval: str) -> pd.DataFrame:

return df.resample(new_interval).agg({

"timestamp": "first",

"openInterest": "first"

})

oi_daily = resample_bybit_oi(df=all_oi, new_interval='D')

print(oi_daily)

'''

timestamp openInterest

timestamp

2022-01-01 00:00:00+00:00 1640995200000 15863.152

2022-01-02 00:00:00+00:00 1641081600000 15636.474

2022-01-03 00:00:00+00:00 1641168000000 15370.184

2022-01-04 00:00:00+00:00 1641254400000 17275.287

2022-01-05 00:00:00+00:00 1641340800000 15976.977

... ... ...

2025-04-03 00:00:00+00:00 1743638400000 49369.163

2025-04-04 00:00:00+00:00 1743724800000 48211.773

2025-04-05 00:00:00+00:00 1743811200000 50905.811

2025-04-06 00:00:00+00:00 1743897600000 50464.327

2025-04-07 00:00:00+00:00 1743984000000 52375.214

[1193 rows x 2 columns]

'''

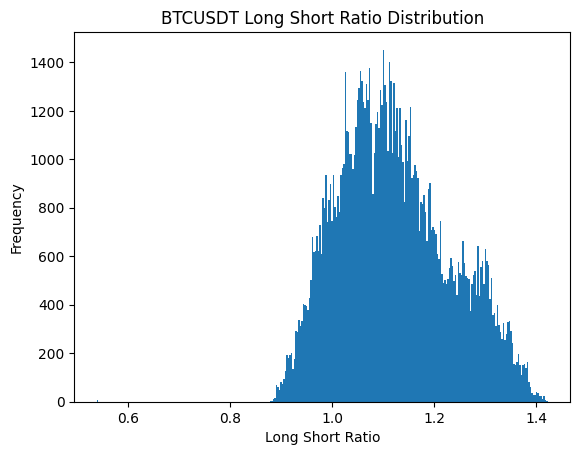

📈 What is the Long-Short Ratio ?📉

📊 Long/Short Account Ratios Explained

- Long Account Ratio = No. of holders with long positions / Total no. of holders

- Short Account Ratio = No. of holders with short positions / Total no. of holders

- Long/Short Ratio = Long Account Ratio / Short Account Ratio

It goes without saying — this is a fantastic tool for gauging crypto market sentiment 🧠. It gives us insight into how many traders are positioned long vs short.

That said, a very high long ratio can also be a warning sign 🚨 — it might mean the market is getting overheated as if everyone is already long then maybe not many new buyers can enter the market.

Get Long Short Ratio with Python🐍

This endpoint is very similar to the open interest one 🔁

peiod = "15min"

symbol = 'BTCUSDT'

end = increment_oi_timestamp(start_ts=start, unit='15min', n_units=199)

response =client.get_long_short_ratio(category='linear', symbol=symbol, period=interval, limit=500)

response.get('result',{}).get('list',[])

'''

[{'symbol': 'BTCUSDT',

'buyRatio': '0.5357',

'sellRatio': '0.4643',

'timestamp': '1641012300000'}]

From this, we get back a list of dictionaries, each containing the latest long/short account ratio data .

Now, let’s go ahead and fetch all the long/short ratio data for the BTCUSDT futures contract on Bybit. This will give us a clearer picture of trader positioning over time — super useful for sentiment analysis and strategy building towards a profitable trading bot🔍.

## get all long short ratio

def format_long_short_ratio(response: list[dict]) -> pd.DataFrame:

if not response:

return pd.DataFrame()

df = pd.DataFrame(response)

df['buyRatio'] = df.buyRatio.astype(float)

df['sellRatio'] = df.sellRatio.astype(float)

df['long_short_ratio'] = df.buyRatio / df.sellRatio

df['timestamp'] = df.timestamp.astype(int)

df.index = pd.to_datetime(df.timestamp, unit='ms', utc=True)

return df.sort_index()

start = int(dt.datetime(2022, 1, 1, tzinfo=dt.timezone.utc).timestamp()* 1000)

peiod = "15min"

symbol = 'BTCUSDT'

all_long_short = pd.DataFrame()

end = increment_oi_timestamp(start_ts=start, unit='15min', n_units=199)

while True:

response = client.get_long_short_ratio(category='linear',

symbol=symbol,

startTime=start,

endTime=end,

period=interval, limit=500)

latest = format_long_short_ratio(response.get('result', {}).get('list',[]))

start = get_last_timestamp(latest)

end = increment_oi_timestamp(start_ts=start, unit=interval, n_units=199)

time.sleep(0.01)

all_long_short = pd.concat([all_long_short, latest])

print(f'Collecting data starting {dt.datetime.fromtimestamp(start/1000)}')

if len(latest) == 1: break

all_long_short.drop_duplicates(subset=['timestamp'], keep='last', inplace=True)

'''

Collecting data starting 2022-01-01 04:45:00

Collecting data starting 2022-01-01 09:30:00

Collecting data starting 2022-01-01 14:15:00

Collecting data starting 2022-01-01 19:00:00

Collecting data starting 2022-01-01 23:45:00

Collecting data starting 2022-01-02 04:30:00

Collecting data starting 2022-01-02 09:15:00

Collecting data starting 2022-01-02 14:00:00

Collecting data starting 2022-01-02 18:45:00

Collecting data starting 2022-01-02 23:30:00

'''

Save the data to the data folder we have created.

## 💾 to disk

all_long_short.to_csv('data/BTCUSDT_long_short_15min.csv', index=False)

Plot the distribution of the ratio

all_long_short.long_short_ratio.plot.hist(bins=300)

plt.title(f"BTCUSDT Long Short Ratio Distribution")

plt.xlabel(f"Long Short Ratio")

plt.ylabel(f"Frequency")

🚀 Bybit Python Tools

A clean, modular toolkit for algo trading on Bybit using Python. Includes helper methods, API key management, and more.

View on GitHub