Sharpe, Sortino and Calmar Ratios with Python

algo trading

Sharpe ratio

calmar ratio

quant finance

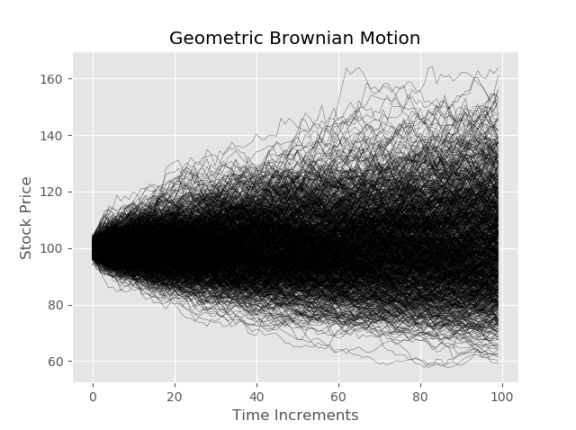

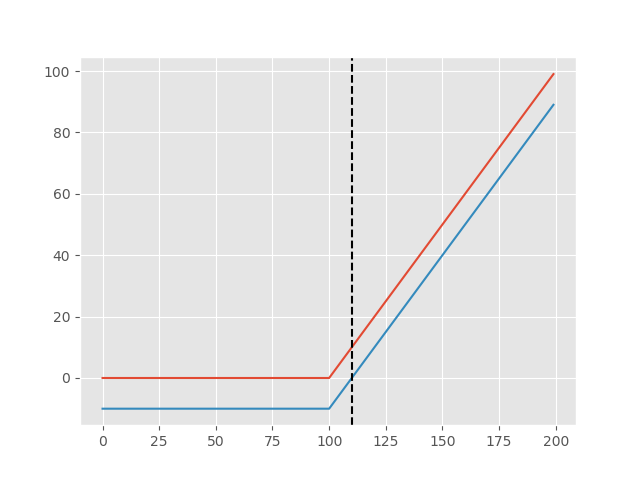

Downloading stock data from Yahoo Finance using pandas datareader. Calculating the Sharpe, Sortino and Calmar ratios for stocks in the S&P 500 along with a portfolio for comparison. Calculating max drawdown and comparing results using Python.

Read More

Published on October 17, 2020