In this article we will calculate the a number of well know statistics related to risk and reward in equities. In order to provide examples on real data we will use the following stocks to illustrate the concepts shown. Since the statistics in question are usually calculated on a portfolio, we will add an equal weighted portfolio to the analysis also.

- Apple: Stock ticker = AAPL

- Amazon: Stock ticker = AMZN

- Facebook: Stock ticker = FB

- Google: Stock ticker = GOOGL

- Microsoft: Stock ticker = MSFT

- Port: Equally weighted portfolio of the securities above.

Statistics to be calculated

- Sharpe ratio

- Sortino Ratio

- Max Drawdown

- Calmar Ratio

Getting the Data

In order to get the data necessary to complete this analysis we will make use of Pandas Datareader, which allows us to directly download stock data into Python. Execute the following code block in your editor:

import pandas_datareader.data as web

import datetime as dt

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

plt.style.use('ggplot')

start = dt.datetime(2013, 1, 1)

end = dt.datetime(2020, 10, 1)

tickers = ['AAPL', 'AMZN', 'MSFT', 'GOOGL','FB']

stocks = web.DataReader(tickers,

'yahoo', start, end)['Adj Close']

stocks.head()

Out:

Symbols AAPL AMZN MSFT GOOGL FB

Date

2013-01-02 17.094694 257.309998 23.241472 361.987000 28.000000

2013-01-03 16.878920 258.480011 22.930120 362.197205 27.770000

2013-01-04 16.408764 259.149994 22.500971 369.354340 28.760000

2013-01-07 16.312239 268.459991 22.458902 367.742737 29.420000

2013-01-08 16.356150 266.380005 22.341091 367.017029 29.059999

Change the dataframe to percentage change and create a column for the equally weighted portfolio. Plot the normalized stock prices for comparison.

df = stocks.pct_change().dropna()

df['Port'] = df.mean(axis=1) # 20% apple, ... , 20% facebook

(df+1).cumprod().plot()

(df+1).cumprod()[-1:]

The plot shows the growth of $1 invested on 1st Jan 2013 until 10th Oct 2020. For every $1 you invested in Apple in 2013 you would now have approximately $7 and so-forth.

Symbols AAPL AMZN MSFT GOOGL FB Port

Date

2020-10-01 6.831944 12.518985 9.141418 4.110369 9.5225 8.936468

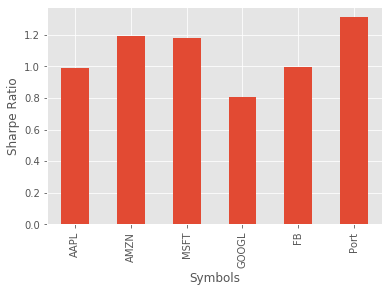

Sharpe Ratio

The Sharpe ratio is the most common ratio for comparing reward (return on investment) to risk (standard deviation). This allows us to adjust the returns on an investment by the amount of risk that was taken in order to achieve it. The Sharpe ratio also provides a useful metric to compare investments. The calculations are as follows:

\(\text{Sharpe ratio} = \frac{\bar{R}-R_f}{\sigma}\)

\(\bar{R} \): annual expected return of the asset in question.

\(R_f\) : annual risk-free rate. Think of this like a deposit in the bank earning x% per annum.

\(\sigma\) : annualized standard deviation of returns

Since our data frequency is daily we need to annualize the expected return and standard deviation. This can be achieved by multiplying the daily average return by 255. And multiplying the daily standard deviation by \(\sqrt 255\). For simplicity we will assume that the risk-free rate \(R_f\) = 1% throughout the 7 year period.

Python code to calculate Sharpe ratio:

def sharpe_ratio(return_series, N, rf):

mean = return_series.mean() * N -rf

sigma = return_series.std() * np.sqrt(N)

return mean / sigma

N = 255 #255 trading days in a year

rf =0.01 #1% risk free rate

sharpes = df.apply(sharpe_ratio, args=(N,rf,),axis=0)

sharpes.plot.bar()

The interpretation of the Sharpe ratio is that higher numbers relate to better risk-adjusted investments. Recall the total return numbers we calculated previously, and notice that even though the majority of the individual stocks had a higher return, they also had a higher standard deviation.

Sortino Ratio

The Sortino ratio is very similar to the Sharpe ratio, the only difference being that where the Sharpe ratio uses all the observations for calculating the standard deviation the Sortino ratio only considers the harmful variance. So in the plot below, we are only considering the deviations colored red. The rationale for this is that we aren't too worried about positive deviations, however, the negative deviations are of great concern, since they represent loss of our money.

\(\text{Sortino ratio} = \frac{\bar{R}-R_f}{\sigma^-}\)

Everything in the ratio above is the same as the Sharpe ratio except \(\sigma^-\) represents the annualized down-side standard deviation.

Python code to calculate and plot the results.

def sortino_ratio(series, N,rf):

mean = series.mean() * N -rf

std_neg = series[series<0].std()*np.sqrt(N)

return mean/std_neg

sortinos = df.apply(sortino_ratio, args=(N,rf,), axis=0 )

sortinos.plot.bar()

plt.ylabel('Sortino Ratio')

It looks like Amazon and the portfolio are almost neck-and-neck in terms of performance for this ratio. As with the Sharpe ratio, higher values are preferable.

Max Drawdown

Max drawdown quantifies the steepest decline from peak to trough observed for an investment. This is useful for a number of reasons, mainly the fact that it doesn't rely on the underlying returns being normally distributed. It also gives us an indication of conditionality amongst the returns increments. Whereas in the previous ratios, we only considered the overall reward relative to risk, however, it may be that consecutive returns are not independent leading to unacceptably high losses of a given period of time.

To calculate max drawdown first we need to calculate a series of drawdowns as follows:

\(\text{drawdowns} = \frac{\text{peak-trough}}{\text{peak}}\)

We then take the minimum of this value throughout the period of analysis.

Python code to calculate max drawdown for the stocks listed above.

def max_drawdown(return_series):

comp_ret = (return_series+1).cumprod()

peak = comp_ret.expanding(min_periods=1).max()

dd = (comp_ret/peak)-1

return dd.min()

max_drawdowns = df.apply(max_drawdown,axis=0)

max_drawdowns.plot.bar()

plt.yabel('Max Drawdown')

I believe max drawdown is usually presented as an absolute value, however, I will leave it the way it is for the time being. It looks like the portfolio performed the best according to max drawdown during the 7 year period we analyzed. The max drawdown should be interpreted as; numbers closer to zero are preferable.

Calmar Ratio

The final risk/reward ratio we will consider is the Calmar ratio. This is similar to the other ratios, with the key difference being that the Calmar ratio uses max drawdown in the denominator as opposed to standard deviation.

\(\text{Calmar ratio} = \frac{\bar{R}}{\text{max drawdown}}\)

calmars = df.mean()*255/abs(max_drawdowns)

calmars.plot.bar()

plt.ylabel('Calmar ratio')

It appears that Microsoft performs the best according to this ratio. As with the Sharpe and Sortino, higher values are preferable.

Wrapping up

If you would like to see these ratios applied to a more realistic backtest you can take a look at this crypto-algo trading example

Let's combine all the ratios we have calculated and put them in a pandas dataframe.

btstats = pd.DataFrame()

btstats['sortino'] = sortinos

btstats['sharpe'] = sharpes

btstats['maxdd'] = max_drawdowns

btstats['calmar'] = calmars

btstats

Out:

sortino sharpe maxdd calmar

Symbols

AAPL 1.286527 0.988260 -0.385159 0.758557

AMZN 1.678367 1.194467 -0.341038 1.107348

MSFT 1.549506 1.181460 -0.280393 1.158764

GOOGL 1.127802 0.808867 -0.308708 0.704477

FB 1.413423 0.994674 -0.429609 0.823078

Port 1.676891 1.311674 -0.274688 1.140057

Plotting dataframe as table

(df+1).cumprod().plot(figsize=(8,5))

plt.table(cellText=np.round(btstats.values,2), colLabels=btstats.columns,

rowLabels=btstats.index,rowLoc='center',cellLoc='center',loc='top',

colWidths=[0.25]*len(btstats.columns))

plt.tight_layout()