Bitcoin options trading has become extremely popular with crypto traders looking to hedge downside risk or aim for leveraged profits 🚀. Unlike spot trading,Crypto options let you buy or sell Bitcoin at a specific price within a set timeframe – giving you more flexibility and control.

If you're exploring Bitcoin options trading, the most important step is choosing the best crypto options platform 🧠. In this post, we’ll break down some of the top Bitcoin options exchanges, cover platforms that offer demo trading accounts 🎮, and share key tips for managing risk while trading crypto derivatives ⚖️.

So, What Are Bitcoin Options?

Bitcoin options are a type of crypto derivatives contract that give traders the right — but not the obligation — to buy (call option) or sell (put option) Bitcoin at a predetermined price before a specific expiration date. These crypto options are widely used by traders to hedge against market volatility or to speculate on Bitcoin price movements with reduced upfront capital.

One of the major advantages of trading call and put options is the ability to gain leverage without the risk of liquidation — unlike margin or futures trading, where sudden price swings can wipe out your position. With options, your maximum loss is limited to the premium paid, making them a popular tool for managing risk in crypto.

Call Option Example

Let’s take an example of two traders: one is considering buying a call option, and the other is thinking about selling a call option. In this example, we’ll give some rationale for why each trader might have entered their respective options position. We’ll also show the payoff diagrams for each of their option strategies 📈.

In this example, we’ll use a Bitcoin call option with a strike price of $100,000 💵. This gives the trader who buys the call a conditional long position on 1 BTC—meaning they have the right (but not the obligation) to buy Bitcoin at $100K if the price is above that level when the option expires. Let’s say this option expires in 3 months ⏳. To enter this position, the call buyer pays a $2,000 premium 💵 to the person or market maker who sells (writes) the option.

Long Trader

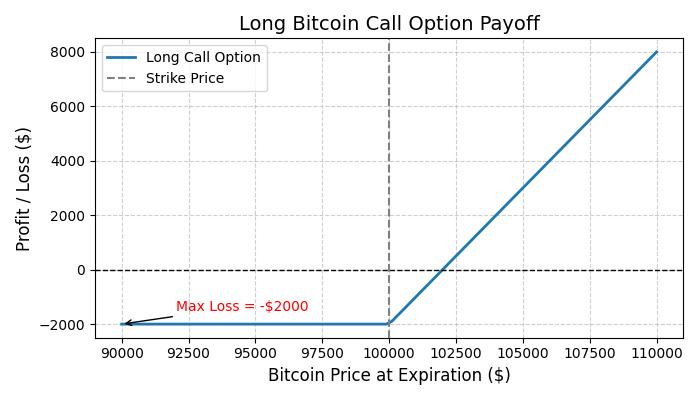

So, the long trader is the one who must pay the option premium 💵. The diagram below shows their potential profit when the option expires in 3 months ⏳. As you can see, if Bitcoin makes a strong move upward, the payoff can exceed 3–4x the initial premium—especially if BTC finishes well above $100K at expiration.

On the other hand, if Bitcoin doesn’t rally within the next 3 months ⏳, the $2,000 premium paid by the long trader will be fully retained by the short option seller—a total loss for the buyer.

Why might this trader buy a call option?

- Simplest explanation might be he wants to take a leveraged position with the risk of liquidation.

- Perhaps he has entered a short futures position and wants to hedge upside risk

ShortTrader

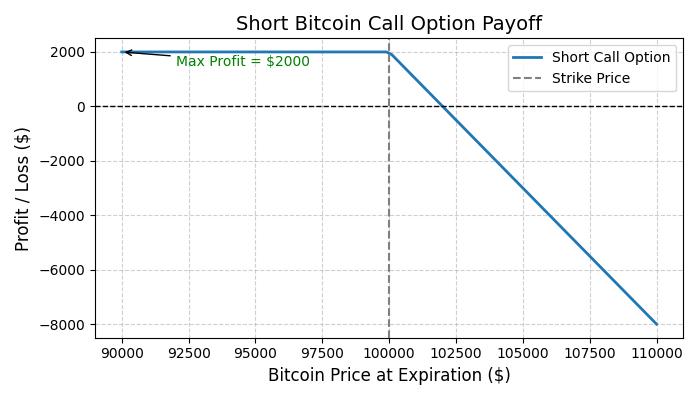

Notice from the diagram below that the short Bitcoin option payoff at expiry in 3 months is the exact mirror opposite of the long trader's position — which makes sense, since it's a contract between the two (likely facilitated by a market maker). Because the long trader’s profits are uncapped to the upside, the short trader faces potentially unlimited losses. ⚠️ This highlights the asymmetric risk of being short: limited upside (the premium received) but unlimited downside if Bitcoin surges — a strong reminder of the importance of risk management in options trading.

Why might this trader sell a call option?

- For those that are new to options, it may seem strange why someone would want to take this risk, but generally options are overpriced and sophisticated traders can make a profit from selling them and hedging the risk.

- Perhaps this trader is long spot and wants to earn a yield on their Bitcoin spot position. This is known as a covered call strategy.

Put Option Example

Let’s take an example of two traders: one is considering buying a put option, and the other is thinking about selling that same put option. In this example, we’ll look at the reasoning behind why each trader might choose to enter their respective options position. We’ll also show the payoff diagrams for each of their option strategies 📉.

In this case, we’ll use a Bitcoin put option with a strike price of $80,000 💵. This gives the trader who buys the put a conditional short position on 1 BTC—meaning they have the right (but not the obligation) to sell Bitcoin at $80K if the price drops below that level when the option expires. Let’s say the option expires in 3 months ⏳. To enter this position, the put buyer pays a $1,400 premium 💵 to the trader or market maker who sells (writes) the put.

Long Trader

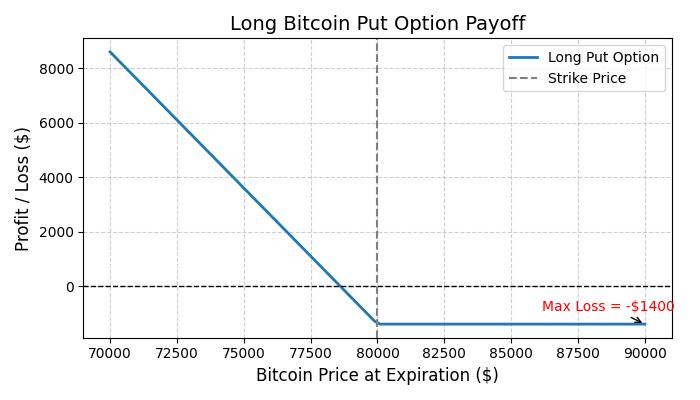

So, the long trader is the one who must pay the option premium 💵. The diagram below shows their potential profit when the put option expires in 3 months ⏳. As you can see, if Bitcoin makes a strong move downward, the payoff can grow significantly—potentially exceeding 3–4x the initial premium—especially if BTC finishes well below $80K at expiration.

On the other hand, if Bitcoin stays above $80K over the next 3 months ⏳, the $1,400 premium paid by the long trader will be fully retained by the short put seller—resulting in a total loss for the buyer.

Why might this trader buy a put option?

- Perhaps he wants to take a leveraged position with a directional view that Bitcoin will go down.

- Perhaps he is long a Bitcoin futures contract or a spot position and wants to manage the downside risk of Bitcoin which is notoriously volatile.

Short Trader

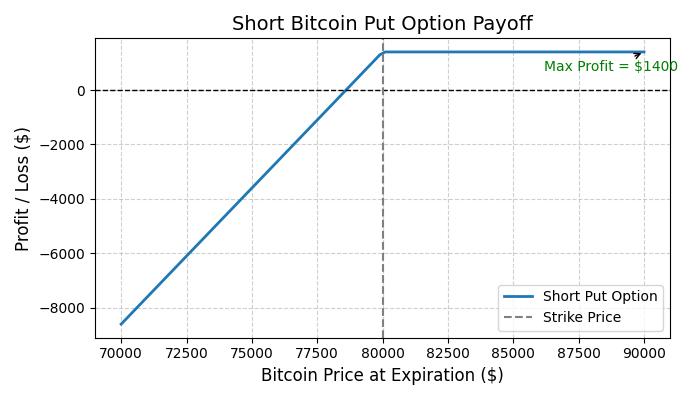

The short trader receives the $1,400 premium 💵 upfront for selling the put option. If Bitcoin stays above $80K through the next 3 months ⏳, they keep the entire premium as profit. However, if BTC drops sharply below the strike, their losses can increase significantly as they're obligated to buy at $80K while the market trades lower.

Why might this trader sell a put option?

- Perhaps he wants to take a leveraged position with a directional view that Bitcoin will go down.

- Perhaps he is engaging in what is known as a cash-secured-put strategy which means he has 80k$ in cash and is willing to buy BTC at that price if it gets there, but earn a yield on his cash position if it doesn't.

Top Exchanges to Trade Crypto Options

There are several trading tools today where users can trade crypto options, though not all are equal. There are those with professional traders in mind and others geared towards beginners that offer a demo trading crypto setting where users can practice without spending actual money. Below are three of the best exchanges for trading crypto options:

1. Bybit

Bybit has quickly risen to prominence as a trusted name in the world of crypto derivatives. Known for its robust crypto options trading—particularly with a focus on Bitcoin —Bybit appeals to both beginners and experienced traders alike. One of its standout features is a demo trading environment, which gives users a chance to sharpen their strategies and gain confidence without risking real funds.

The platform offers both USDT- and USDC-margined crypto options, providing added flexibility when it comes to managing risk. Its clean and user-friendly interface makes it especially accessible for those just getting started in options trading. Whether you're experimenting with new strategies or simply looking to get a feel for the market, Bybit offers a supportive and feature-rich space to grow your skills.

2. Deribit

Deribit has earned a reputation as one of the pioneering platforms for Bitcoin options trading and remains a top choice among professional traders. It offers a wide range of crypto options for both Bitcoin and Ethereum, backed by strong liquidity and competitive fees. For more experienced traders, Deribit provides a suite of powerful tools—including options Greeks and implied volatility charts—designed to support in-depth analysis and strategic decision-making.

For those still learning the ropes, Deribit also offers a dedicated testnet environment. This demo trading account allows users to explore the platform and practice trading without financial risk, making it an invaluable resource for developing skills and building confidence before going live.

3. OKX Exchange

OKX stands out as a well-established crypto trading platform offering Bitcoin options with a strong balance of usability and professional-grade features. Known for its intuitive interface and deep liquidity, OKX supports a wide range of trading strategies while also prioritizing risk management. The platform features European-style crypto options, which are well-suited for traders who prefer structured, expiration-based strategies.

To support skill development, OKX includes a demo trading mode that lets users explore the platform and test their approaches without putting real capital at risk.

💡 Bitcoin Options Trading Tips

Crypto Demo Accounts: The Best Way to Practice Risk-Free

If you’re new to crypto options, demo trading platforms like Bybit, Deribit, and OKX are a great place to start 🧪. They let you practice real strategies in real-time conditions — with zero risk 🛡️.

Even for experienced traders, demo accounts are useful for testing new platforms or backtesting ideas 🔁.

In short: demo trading is the best way to build confidence 💪, refine your strategy 🧠, and prepare for live markets 🚀.